UX Design & Strategy for Kiido - A Family-Themed Startup

Client: Calculai

Calculai, a global decision sciences company was working on a new venture, Kiddo - a family-themed app to assist family members as they coordinate their lives around managing their kids well. I was brought on to develop wireframes and user flows for the financial management section of the application.

The Problem

The composition of households is changing. In an increasingly complex world, it is harder than ever to raise a child, especially when separated from your partner. The goal of this app is to help co-parenting individuals coordinate their lives so that their focus remains on their children.

-

I was brought on for a 4-week contract as one of two UX Designers to help identify MVP features, develop wireframes, map out user flows, and build a working prototype to be used for user testing.

-

Stakeholder Interviews

Brainstorming

Wireframing

User Flows

Prototyping

-

Sketchbook

Figma

Google Suite

Miro

Stakeholder Interviews

Background Research

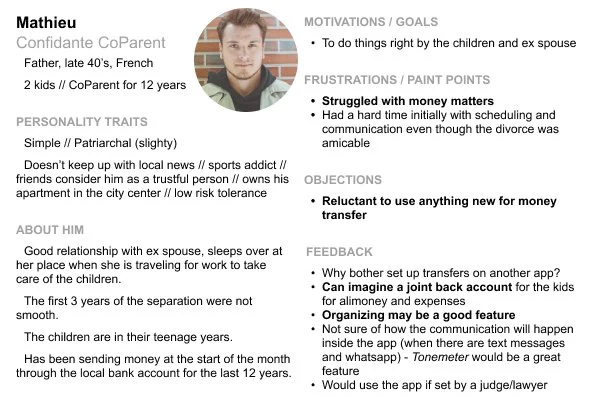

Calculai came to the project with an impressive collection of user and competitor research. As a UX Designer with limited time on the project, it was important to interview the stakeholder who collected the data in order to quickly synthesize the information. Their pre-assembled research enabled me, as a designer, to focus on the task at hand: creating wireframes and mapping out user flows for the key MVP features of the application.

User Challenges

Managing expenses related to family

Scheduling

Sharing Photos/Videos

Storage of important documents

Value Proposition

- Being a parent in the modern world is hard. The focus should be on the kids, not coordinating life.

Defining MVPs

After collecting the necessary information, our first task was to help Calculai define what the Minimum Viable Product needed to be for the application. Based on the user research that had been collected, we identified five features that needed to be included in the initial product offering.

An excellent onboarding experience

A tool to manage finances regarding children

A messaging tool

A scheduling tool

A place to organize and store key contacts and documents relating to children

Due to our limited time on the project, we drilled down further to uncover what features needed UX expertise. After discussions, we agreed that the onboarding experience and the financial management tool added the most value to users and therefore should be focused on first.

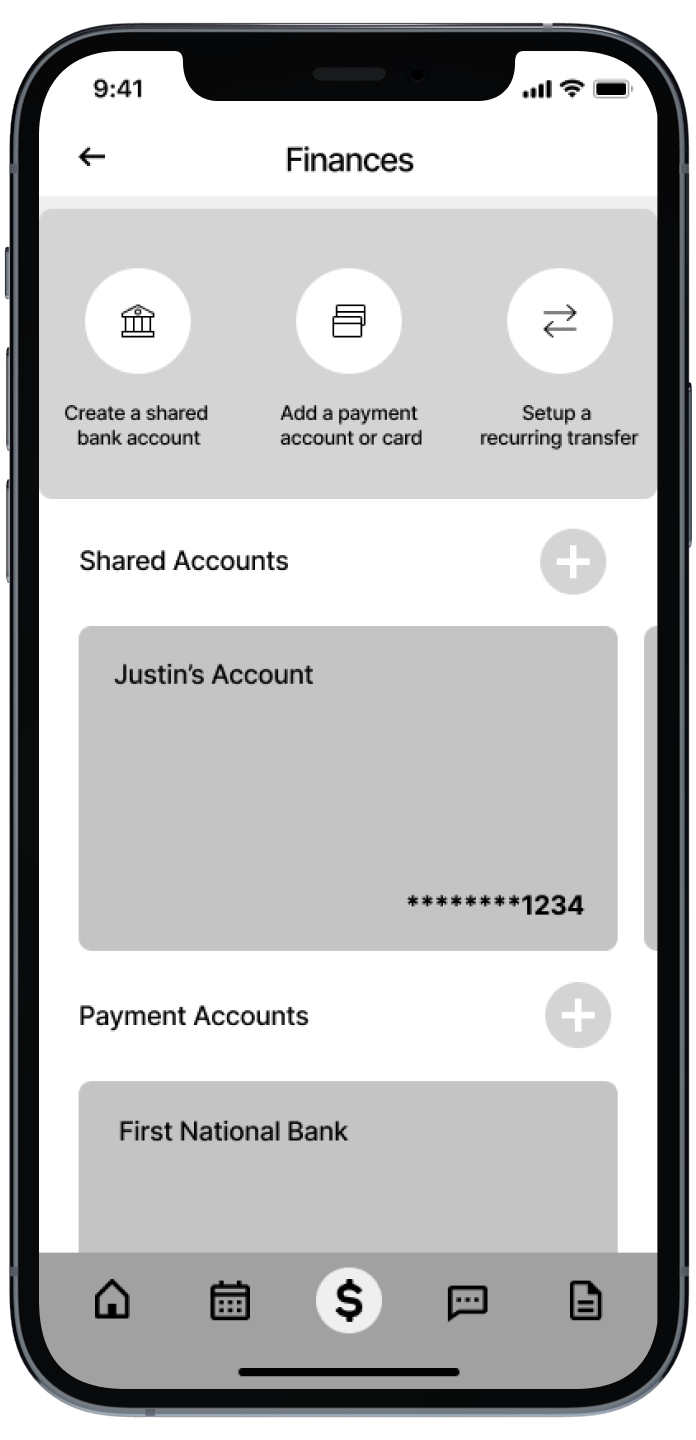

Financial Management Tool Design

Calculai leadership strongly believed that the financial management tool was one feature that would differentiate the application from the competition. By the end of the project, I had designed 4 user flows for the financial management section of the application. These four flows were developed through the use of stakeholder interviews, synthesizing user research, competitor research, and iterative design.

Four User Flows of the Financial Management Tool

First-time use flow

Setting up an account flow

Add a payment account flow

Transfer money to account flow

First-Time Use Flow

Calculai leadership wanted a strong first-time use flow. The overall application requires a lot of information from the user. The fear was that asking for all required information during the onboarding process would overwhelm the user leading to sign-up abandonment. Instead of asking for all of the information during the onboarding process, it was determined that information should only be gathered when it is necessary for the operation of the specific tool.

For the financial management tool, this meant that I needed to design flows that captured the required information from users at the correct time. Based on user research, I knew that users needed to know why information was being asked of them; especially when that information was in reference to their children and their finances.

I determined that before any information was asked of the user, they needed to have a mental model of how the tool would assist them as they manage their household. As a result, I designed a mini-onboarding process for the financial management tool that showcases to the user how the application helps them manage finances related to their families.

Setting Up Account Flow

The core of the application's financial management tool is the ability for users to set up an account to manage finances related to their family. Many of the features for this account were still under development and so specifics in regards to account creation were yet to be determined. Still, we wanted to get a sense of what the flow would look like for account creation to help inform future decision-making.

After consulting user and competitor research, I determined that the setup of an account should have three steps in the initial user flow.

Verify the parents' identity

This step is necessary to comply with laws surrounding financial account creation

More research is needed to determine the correct steps needed to comply with the law

Select the child/children the account is for

Children are added to the parent's account in a different section of the application. If no child has been added, the user will be directed to that section to add a child before creating an account.

Transfer funds into the account

Before funds can be added to the new account, the user will have to set up a payment account. If no payment account has been added, the user will be directed to the add payment account flow before creating an account.

Add Payment Account Flow

To set up an account, make transfers, or pay for expenses relating to their family, the user must set up a payment account.

To simplify the process for users, I set up the flow where the user only needs to login into their financial institution's online banking system to link their payment account. User testing is needed to determine whether or not users prefer this way of linking their payment account or if they would rather manually input their account and routing information.

Transfer Money to Account Flow

The final user flow that needed to be developed for the financial management tool was the transfer money flow. This feature doesn't become active for a user until they have added at least one account and at least one payment account. I completed extensive competitor research for this flow to see how other applications handle money transfers. Users needed the option to transfer money to and from multiple accounts. Additionally, they needed an option to make the transfer once or recurring.

Final Deliverables & Next Steps

Financial Management Tool User Flow

The finished deliverable included an initial user flow for the Financial Management section of the application and a working prototype to be used for user testing. This flow, incorporating the four individual flows described above, maps out the total user experience for the tool.

*click to view prototype in Figma

Kiido Wireframe Prototype

Equipped with a prototype built from the wireframes and user flows I developed, Calculai is now set up to conduct user testing to see how this tool can solve its users' problems. Although this user flow was developed through extensive research, there is no doubt that this will only be one of many iterations of the tool's design.

Before handing off the final deliverable, I suggested that Calculai address the following questions during user testing:

Does the design make users feel secure about conducting financial transactions? How can this be improved?

How do users prefer to verify their identity? Does this comply with local and federal laws regarding financial account creation?

How do users prefer to link payment accounts? Should other account types (Paypal, etc) be considered?

Next Steps

The next step in the development process for the financial management tool is for Calculai to conduct user testing. Through testing, they will gather the information needed to iterate on the design. Beyond user testing on the financial management section of the application, there are several other steps that will need to be taken as Calculai moves forward on the project.

Other application features will need to be developed to determine how the financial management tool will interact within the ecosystem of the entire application.

Once the application branding has been developed, high-fidelity mockups will need to be created taking into account the results of the user testing conducted with the wireframe prototype.

A high-fidelity prototype of the entire application will need to be created and then tested with users.

There are also still unanswered questions within the financial management tool that will need to be answered. Some answers will come from user testing and some will come as the application gets further developed. Below is a list of questions I feel still need to be answered before the design of the financial management tool is completed.

Does the application comply with the laws surrounding financial account creation and management? How will complying with these laws constrain the design and/or user flow?

How will the financial management tool operate within the broader scope of the overall application? How will the different features interconnect?

What safety features need to be added to make financial transactions through the application secure?

What payment account options do users prefer? How do they prefer to connect said accounts?

How can expenses out of an account be shared or assigned to a specific parent?