Vendor Payment Portal UX Design

Client: Wheels, Inc.

Wheels Inc., a trusted industry leader offering fleet leasing and management services, needed to develop a new payment portal for their vendors. I was brought on to design the User Experience for the new application.

The Problem

LeasePlan and Wheels/Donlen were merging to form one company. During the database integrations, the need arose to help small repair shops request payment for work done to Wheels managed vehicles. This project was crucial during the merger because maintaining client services was a top priority during the transition.

What is the solution?

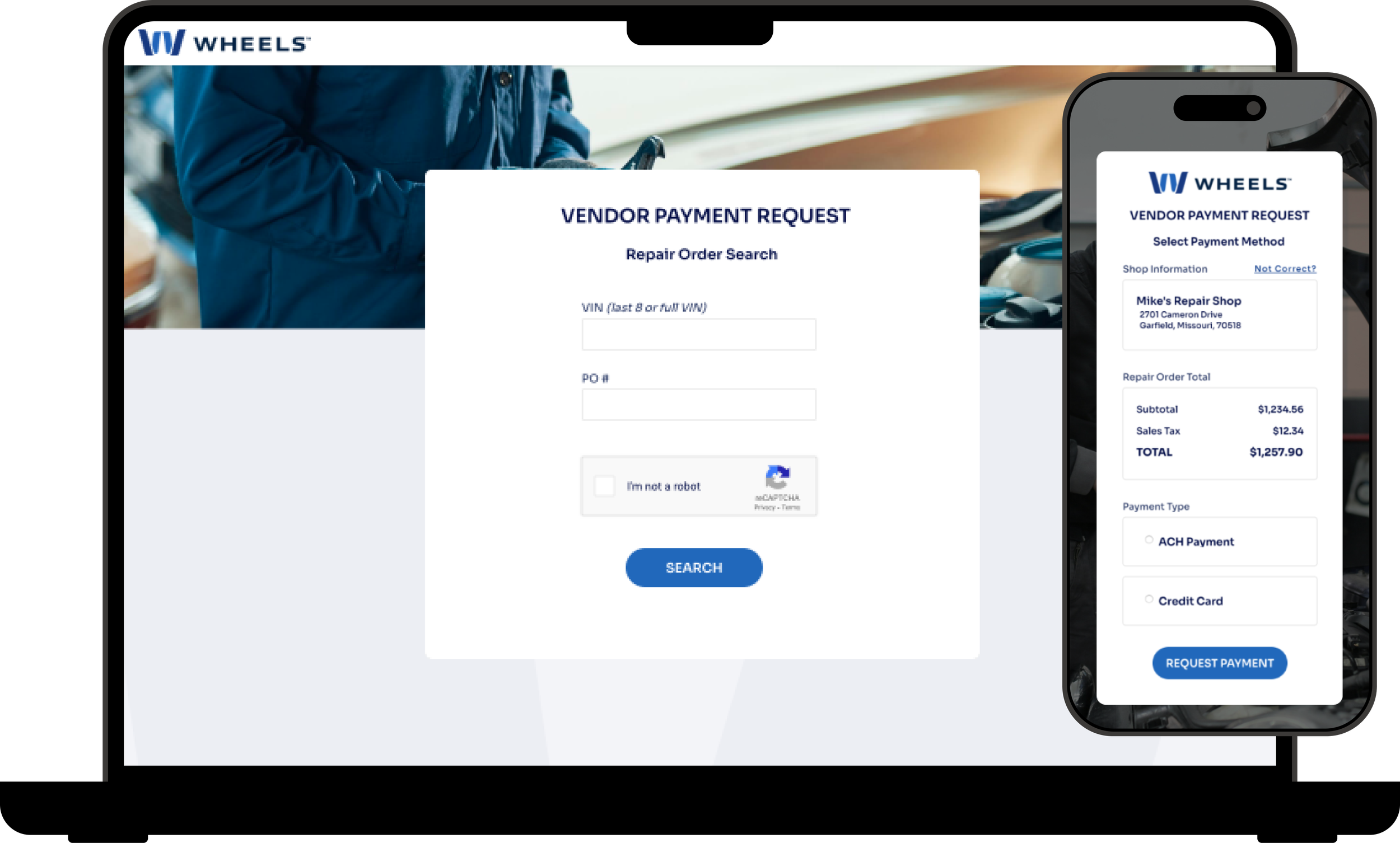

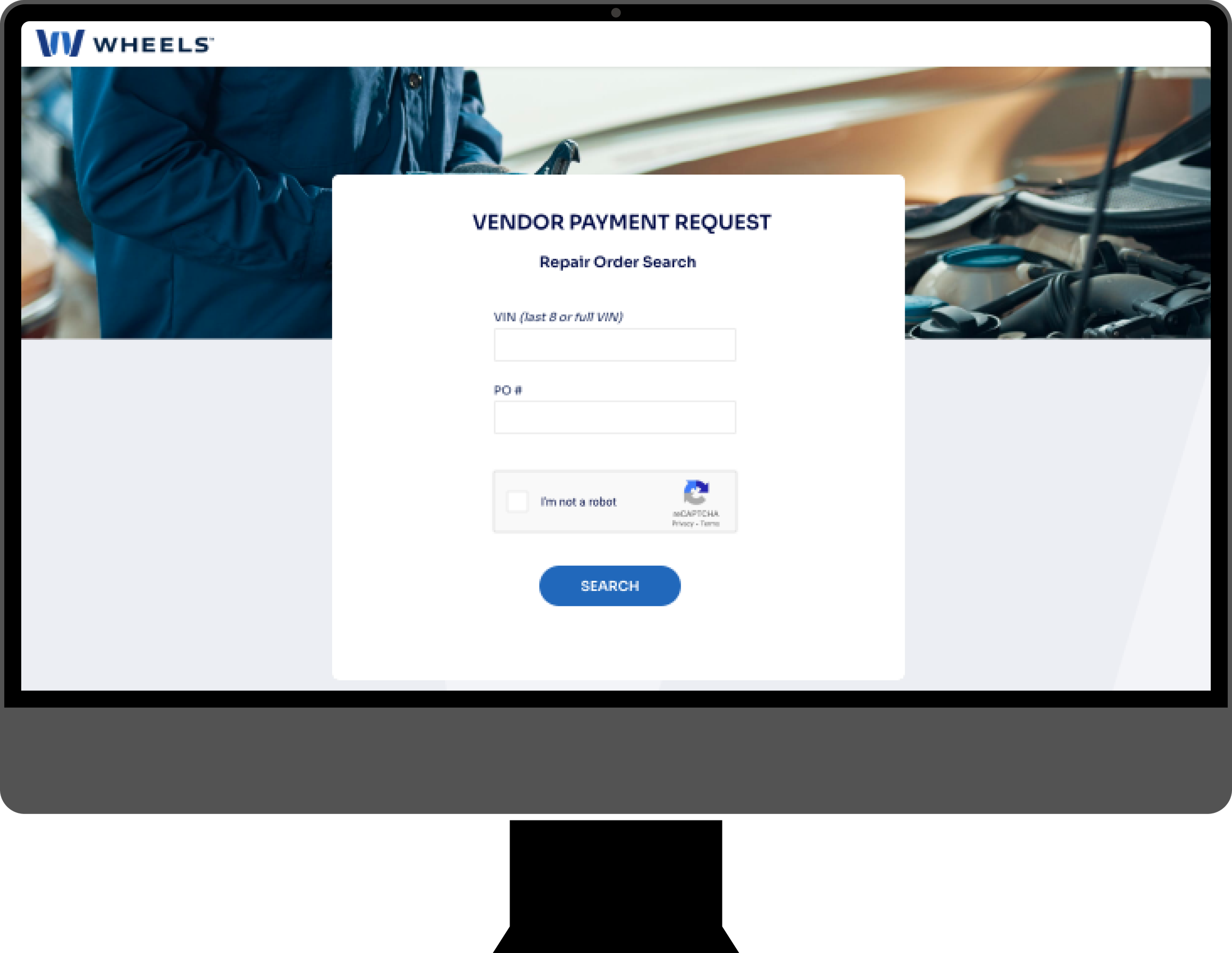

The solution is an online portal tailored for vendors (repair shops) to effortlessly request payment for services provided to Wheels clients. This portal offers a seamless platform for vendors to submit payment requests without the need for complex logins. It boasts a clean and intuitive interface accessible through web browsers, eliminating additional software installation.

What were the results?

The portal's user-friendly design and efficiency significantly improved vendor satisfaction. Payments became hassle-free, reducing the need for direct contact with Wheels. The solution's multi-platform approach, including web and iOS, ensured accessibility. Key tools used in this project were UXPin for wireframes and prototypes and Miro for collaborative brainstorming.

While the happy path for users was straight-forward, the portals asks for specific (and accurate) information based on the clients' pre-approved amounts. Significant time was spent working with the IT Architecture team to determine how best to have users prompt the API calls and to determine the limits which would trigger an error state.

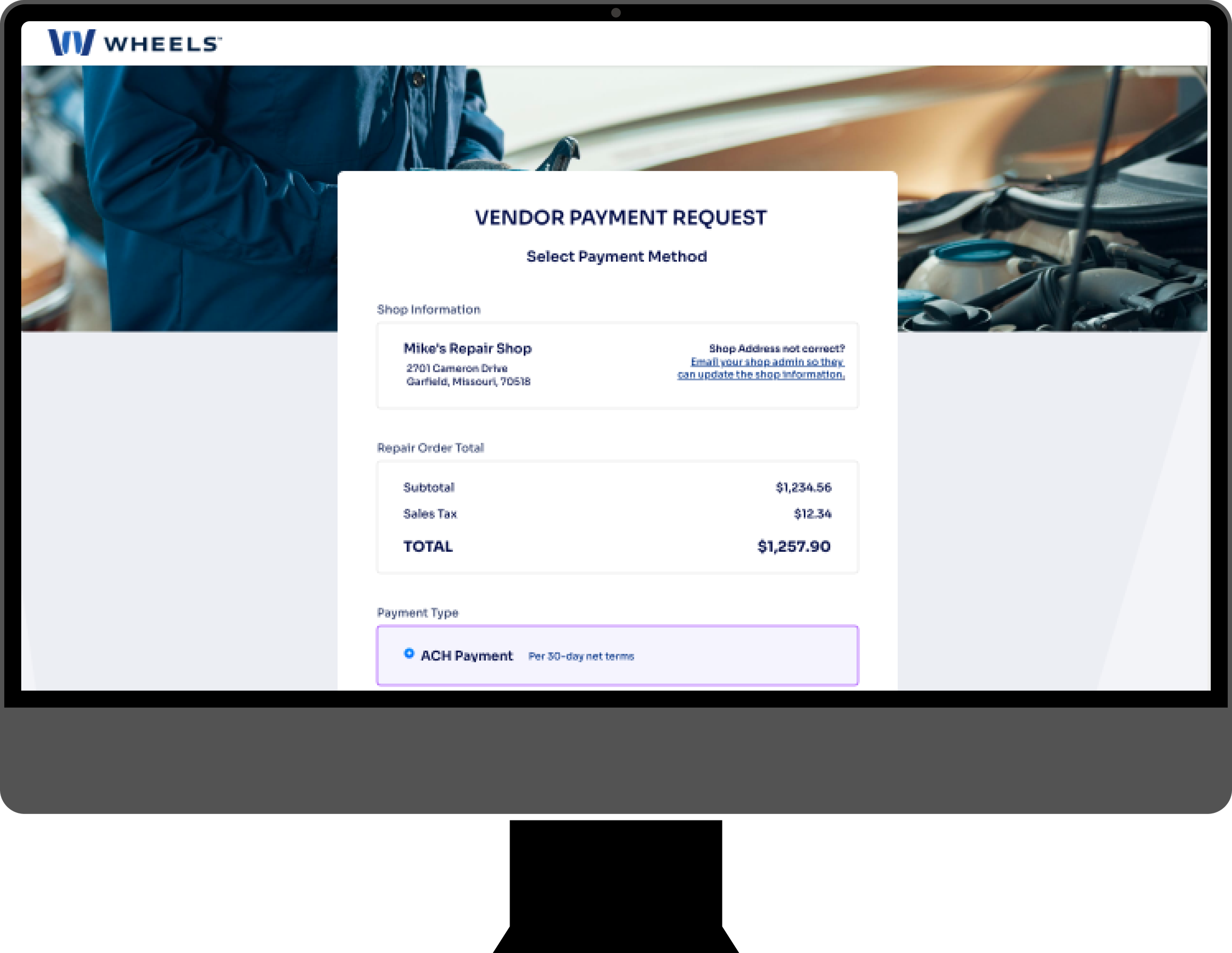

After searching via the VIN and PO# fields, the vendor is then asked to input the invoice subtotal and sales tax amounts. This information was required to check if the final service amount stayed within the set variance that the client pre-approved. If the inputed amounts were within the variance level, then the vendor proceeds through the flow.If the repair is outside the variance allowed, the user is asked to resubmit an itemized list of services for approval.

Once the invoice total and sales tax amounts have been confirmed, the vendor is then asked to review their information and is given a choice on how they receive their payment.

How we got there

Background Research

Both Legacy companies had processes in place for their large repair shops to submit invoices for payment. Since we had insider access to those systems, the team did extensive research into how those applications were built; paying special attention to what worked well and what areas needed improvement. Although our users, small repair shop owners, had slightly different needs, these insights still gave us a solid foundation to build off of.

The Team:

I worked as the sole UX Designer on this project. I facilitated weekly design session with the core product team. These collaborative sessions allowed us to design in an iterative way that kept the user’s needs, the business’s needs, and the technical requirements in balance. The other product team members included:

IT Manager

Business Analyst

Lead Developer

Director of Product Management

Problem Statement

The problem centered around merging databases during the Legacy LeasePlan and Wheels merger. A user-friendly portal was needed for vendors, particularly small repair shops, to request payments easily. The "How might we" statements guided us to simplify access, ensure usability, streamline submissions, provide instructions, accommodate legacy vendors, optimize performance, enhance search, and ensure security.

-

This question addressed the need for an intuitive and user-friendly interface.

-

The focus here was on making the portal accessible to users with different technical backgrounds.

-

Efficiency was key, and we aimed to minimize any unnecessary steps in the process.

-

Communication was crucial, and the portal needed to guide users effectively.